All Categories

Featured

Table of Contents

If you pick degree term life insurance, you can budget plan for your premiums due to the fact that they'll remain the exact same throughout your term (Level term life insurance for young adults). Plus, you'll recognize precisely just how much of a death benefit your recipients will certainly obtain if you die, as this amount won't transform either. The rates for degree term life insurance coverage will depend on several elements, like your age, health condition, and the insurance provider you select

When you undergo the application and clinical examination, the life insurance policy company will certainly assess your application. They need to notify you of whether you've been accepted shortly after you use. Upon authorization, you can pay your first premium and authorize any relevant documents to guarantee you're covered. From there, you'll pay your costs on a month-to-month or annual basis.

You can select a 10, 20, or 30 year term and take pleasure in the included peace of mind you are entitled to. Working with a representative can help you find a policy that works best for your demands.

This is no matter whether the guaranteed individual passes away on the day the policy begins or the day prior to the plan ends. To put it simply, the quantity of cover is 'degree'. Legal & General Life Insurance Policy is an instance of a degree term life insurance coverage plan. A level term life insurance plan can suit a variety of scenarios and requirements.

Who offers Level Term Life Insurance Policy Options?

Your life insurance coverage plan can additionally develop component of your estate, so could be based on Inheritance Tax obligation learnt more regarding life insurance policy and tax obligation. Let's check out some attributes of Life insurance policy from Legal & General: Minimum age 18 Maximum age 77 (Life insurance policy), or 67 (with Crucial Illness Cover).

The quantity you pay remains the very same, however the level of cover decreases roughly in line with the way a settlement home loan decreases. Lowering life insurance coverage can assist your liked ones remain in the family members home and prevent any further disturbance if you were to pass away.

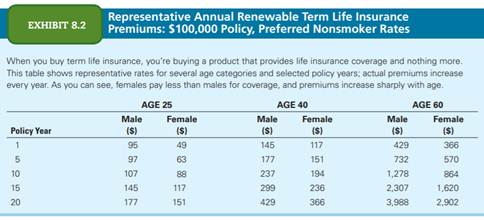

Term life insurance policy gives insurance coverage for a specific time period, or "term" of years. If the insured person dies within the "term" of the policy and the plan is still active (active), after that the fatality benefit is paid to the beneficiary. This sort of insurance typically enables clients to initially purchase more insurance protection for less cash (costs) than other type of life insurance policy.

Is there a budget-friendly Level Term Life Insurance Rates option?

Life insurance acts as a replacement for revenue. The prospective threat of losing that gaining power revenues you'll need to money your family's biggest goals like acquiring a home, paying for your children' education and learning, minimizing financial debt, saving for retirement, etc.

One of the major appeals of term life insurance is that you can get even more coverage for much less money. The insurance coverage expires at the end of the plan's term. Another way term policies differ from whole life or irreversible insurance is that they generally do not develop cash value with time.

The concept behind decreasing the payout later on in life is that the insured expects having actually minimized insurance coverage requirements. For example, you (hopefully) will owe much less on your mortgage and various other financial debts at age 50 than you would certainly at age 30. Therefore, you may choose to pay a lower premium and reduced the amount your beneficiary would certainly get, due to the fact that they would not have as much financial obligation to pay in your place.

What is the best Term Life Insurance With Fixed Premiums option?

Our plans are designed to complete the gaps left by SGLI and VGLI strategies. AAFMAA works to comprehend and sustain your one-of-a-kind monetary goals at every phase of life, tailoring our service to your unique circumstance. online or over the phone with one of our military life insurance policy specialists at and discover more about your military and today.

With this kind of protection, costs are hence ensured to stay the exact same throughout the contract., the quantity of insurance coverage given boosts over time.

Term plans are additionally typically level-premium, but the excess quantity will certainly stay the exact same and not expand. The most usual terms are 10, 15, 20, and three decades, based upon the needs of the insurance holder. Level-premium insurance is a sort of life insurance policy in which premiums remain the very same price throughout the term, while the quantity of protection supplied boosts.

For a term policy, this implies for the length of the term (e.g. 20 or thirty years); and for a permanent policy, up until the insured passes away. Level-premium plans will normally cost even more up-front than annually-renewing life insurance coverage plans with terms of just one year each time. However over the long run, level-premium settlements are commonly more cost-effective.

How can Level Term Life Insurance Protection protect my family?

They each look for a 30-year term with $1 million in insurance coverage. Jen buys a guaranteed level-premium plan at around $42 each month, with a 30-year perspective, for an overall of $500 annually. Beth figures she may just require a plan for three-to-five years or up until full repayment of her existing debts.

In year 1, she pays $240 per year, 1 and around $500 by year five. In years 2 with five, Jen proceeds to pay $500 per month, and Beth has paid a standard of just $357 per year for the exact same $1 countless coverage. If Beth no much longer needs life insurance at year 5, she will have conserved a great deal of cash about what Jen paid.

Each year as Beth grows older, she faces ever-higher annual costs. At the same time, Jen will certainly remain to pay $500 per year. Life insurers are able to provide level-premium policies by essentially "over-charging" for the earlier years of the policy, gathering even more than what is required actuarially to cover the risk of the insured passing away during that early duration.

1 Life Insurance Data, Information And Sector Trends 2024. 2 Expense of insurance rates are determined utilizing methodologies that differ by company. These rates can differ and will normally raise with age. Prices for energetic workers might be different than those offered to terminated or retired workers. It is very important to take a look at all elements when examining the overall competition of rates and the value of life insurance policy coverage.

How much does Best Level Term Life Insurance cost?

Nothing in these products is intended to be guidance for a certain situation or individual. Please consult with your very own experts for such advice - Level term life insurance companies. Like the majority of group insurance plan, insurance plan offered by MetLife have particular exclusions, exemptions, waiting durations, decreases, constraints and terms for maintaining them in force. Please call your benefits manager or MetLife for expenses and complete information.

Table of Contents

Latest Posts

Best Burial Insurance

Final Expense Insurance Agent

Funeral Assurance

More

Latest Posts

Best Burial Insurance

Final Expense Insurance Agent

Funeral Assurance